Professional Tax Management for Malta'sSelf-Employed Community

Streamline your Malta tax obligations with automated calculations, deadline tracking, and seamless tax form generation. Built for accountants and self-employed professionals.

14-day free trial • No credit card required

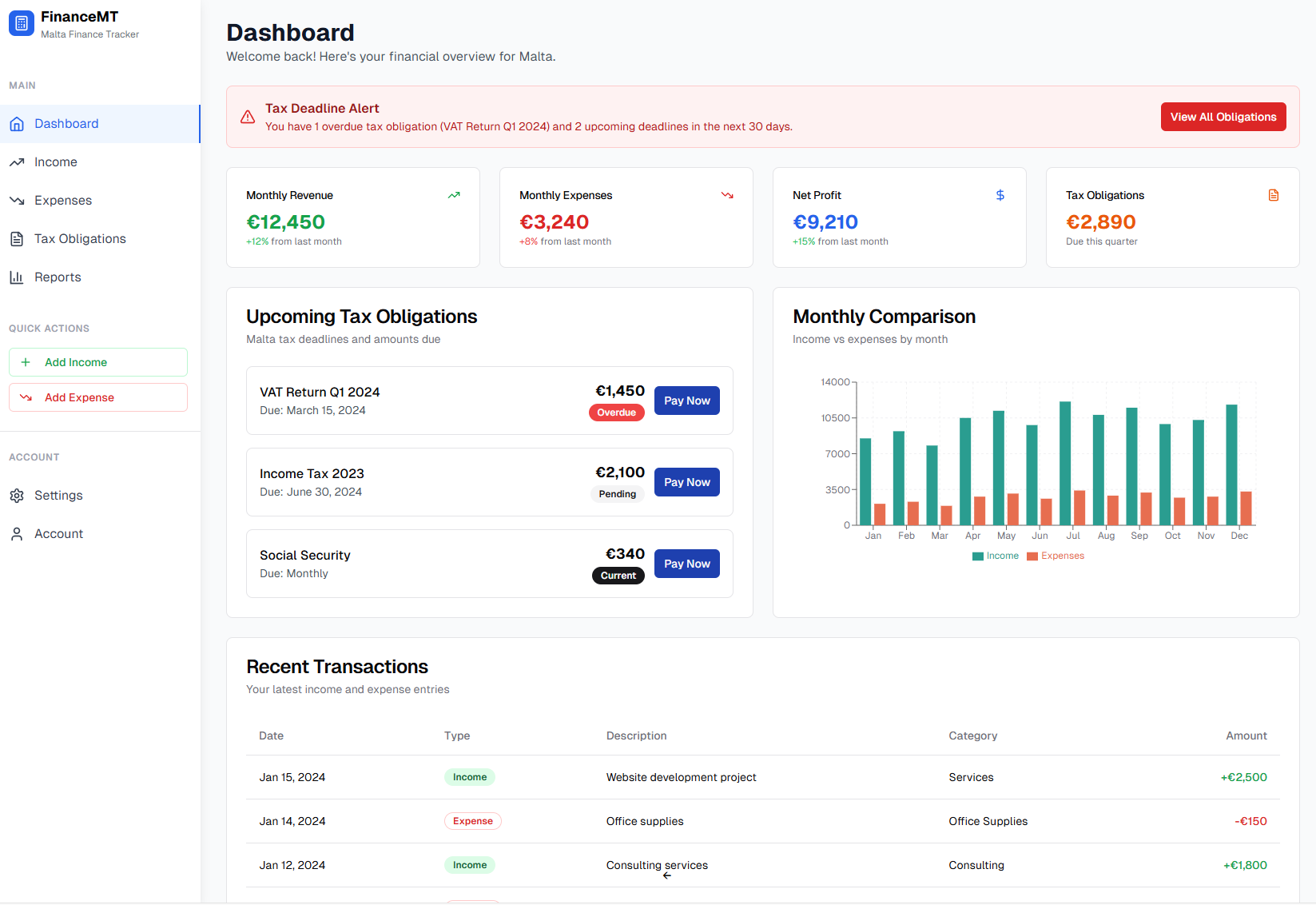

See The Tax Compass in Action

Get a complete overview of your Malta tax obligations with our intuitive dashboard. Track income, monitor expenses, and never miss a deadline.

Comprehensive Overview

Get instant insights into your financial health with key metrics at a glance.

Smart Tracking

Automatically categorize transactions and track your progress month over month.

Malta Compliance

Stay compliant with Malta Tax and Customs requirements automatically.

Built for Malta's Self-Employed Community

Whether you're a freelancer, part-time worker, or accountant serving clients, The Tax Compass streamlines Malta tax compliance and reduces manual reporting errors.

Everything You Need for Malta Tax Compliance

Comprehensive features designed specifically for Malta's tax requirements and self-employed workers.

How The Tax Compass Works

Simple, streamlined process for both self-employed workers and accountants.

For Self-Employed Workers

Upload your income & expense receipts

Upload invoices to automatically track income and expenses.

Review & Categorize

Smart categorization with manual review options to ensure accuracy for Malta tax compliance.

Calculate & File

Automatic tax calculations and form generation for seamless Malta Tax and Customs submissions.

For Accountants

Invite Clients

Send secure invitations to clients to connect their financial accounts and data.

Monitor & Review

Real-time dashboard to monitor client compliance and review automated categorizations.

Generate Reports

Comprehensive reporting and automated form generation for all Malta tax requirements.

Simple, Transparent Pricing

Choose the plan that fits your needs. All plans include Malta tax compliance features.

All plans include 14-day free trial • No setup fees • Cancel anytime

Frequently Asked Questions

Everything you need to know about TaxPlanner and Malta tax compliance.

Is The Tax Compass compliant with Malta Tax and Customs requirements?

Yes, The Tax Compass is specifically designed for Malta's tax system and is fully compliant with Malta Tax and Customs requirements. We regularly update our calculations and forms to reflect the latest tax rates and regulations.

Can The Tax Compass handle both full-time and part-time self-employed workers?

Absolutely. The Tax Compass is designed to handle the tax obligations of both full-time and part-time self-employed workers in Malta, including proper calculation of income tax thresholds and social security contributions.

How does the VAT calculation work for freelancers?

The Tax Compass automatically calculates VAT based on Malta's current rates and thresholds. It tracks your income to determine when you need to register for VAT and helps prepare quarterly VAT returns for submission to Malta Tax and Customs.

What type of tax does The Tax Compass help with?

The Tax Compass helps with and simplifies all tax obligations, including Income Tax, Value Added Tax (VAT) and Social Security Contributions (SSC), for full-time and part-time self-employed individuals looking to be compliant in Malta. The Tax Compass automatically generates these forms based on your tracked income and expenses, ensuring accuracy and compliance.

Is my financial data secure?

Yes, we use bank-level encryption and security measures to protect your data. All information is stored securely and we never share your financial data with third parties. We're also GDPR compliant for EU data protection standards.

Can I try The Tax Compass before committing to a paid plan?

Yes, we offer a 14-day free trial with full access to all features. No credit card is required to start your trial, and you can cancel anytime during the trial period without any charges.

Malta Tax Resources

Stay updated with the latest Malta tax news, guides, and compliance tips.